Michigan roads still crumbling despite nearly 47% budget hike since 2018

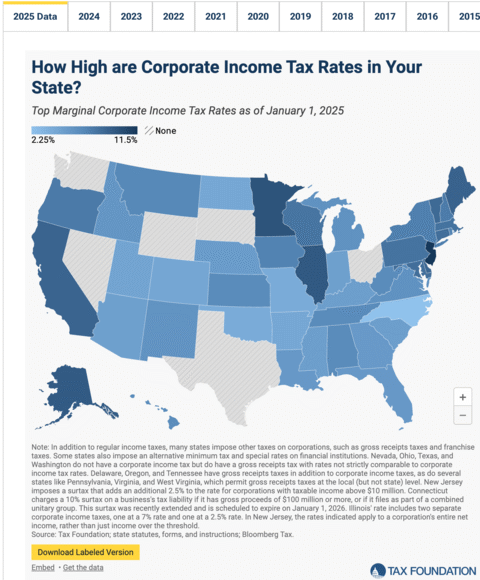

Proposed 8.5% corporate tax would be third highest in Midwest Rankings

Gov. Gretchen Whitmer says Michiganders must pay more to fix the damn roads.

“To my friends in the GOP: fixing the roads in a sustainable way means looking for new, fair sources of revenue,” Whitmer said in her Jan. 15 ‘Road Ahead’ address. “We can’t just cut our way to better roads.”

Approaching a 2026 term limit, Whitmer says that Michigan must raise the corporate income tax rate from 6% to 8.5%, a rate hike she claims would bring in an additional $1.6 billion; impose a 32% wholesale tax on cannabis to raise a projected $470 million; and cut a promised $500M in unspecified spending.

If all Michiganders use the roads, then individuals — not just businesses — should pay to fix them, Randy Gross, Senior Director of Legislative Affairs and Associate General Counsel at the Michigan Chamber of Commerce, told Michigan Capitol Confidential in a phone interview.

“Roads in Michigan are horrible,” Gross said. “We just don’t see the corporate income tax as the appropriate mechanism to do that.”

Michigan should reprioritize its $83.5B budget before raising taxes on residents, Gross said. Most of the companies that pay this tax have fewer than 100 employees, he added.

“This is something that would stifle small business development and growth,” Gross said.

House Bill 4144 would raise the corporate income tax from 6% to 8.5%. If this bill, which was sponsored by Rep. Alabas Farhat, D-Dearborn, is passed by both chambers and by the governor, Michigan’s tax rate will surpass Wisconsin’s corporate income tax rate of 7.9%, Indiana’s 4.9%, and Ohio’s at 0%, according to the Tax Foundation.

In 2023, 47,258 Michigan taxpayers filed to pay the corporate income tax, Ron Leix, a Michigan Treasury spokesman, told CapCon in an email.

In 2018, Michigan’s budget was $56.8 billion. The proposed 2026 state budget is $83.5 billion — a 47% increase despite attracting 120,000 new residents.

We’re spending more money but are not getting more, said Charles Steele, an economics professor at Hillsdale College who has taught in China, Russia, and Ukraine.

“I'm skeptical that simply raising taxes will solve the problem; it is too easy to defer serious highway improvement and shift funds to concentrated constituencies that will help shore up politicians' support,” the former private consultant said.

Raising the corporate income tax would make Michigan a less attractive place to do business, said Steele. Higher taxes, along with recent restraints on business such as the minimum wage increase and the repeal of the state's right-to-work law, are suppressing Michigan's economy, he said.

“A 32% tax at the wholesale level would be a substantial cost increase and disincentivize the marijuana industry here,” Steele wrote. “Competition in neighboring states, such as Ohio, would be strengthened.”

The state has about 48,000 workers, Steele pointed out, and Whitmer’s 2026 budget aims to add another 800 employees and $1 billion in spending. Yet the budget proposal prioritizes specific tax increases over prospective spending cuts.

“The state could use a DOGE of its own to identify and cut programs that primarily serve as employment for bureaucrats,” Steele said.

Michigan should eliminate “green” energy subsidies and mandates that drive up the cost of energy while subsidizing unsustainable wind and solar businesses that that harm the environment, Steele said. The state aims to drive an all-electric fleet by 2040, although it currently has only 30 electric vehicles, CapCon reported.

“If savings from cutting useless or destructive spending is devoted to improving the highway infrastructure, that also makes Michigan more attractive,” Steele said. “It is something the state government could do that would actually be useful.”

Whitmer’s office did not respond to a request for comment.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Lawmakers a step closer to cutting income tax

Lawmakers a step closer to cutting income tax

Bills would redirect corporate welfare to pave roads

Bills would redirect corporate welfare to pave roads

Whitmer wafts 32% tax on pot

Whitmer wafts 32% tax on pot