Bills would redirect corporate welfare to pave roads

Lawmakers find $3B in Michigan’s vast budget to fix roads without hiking taxes

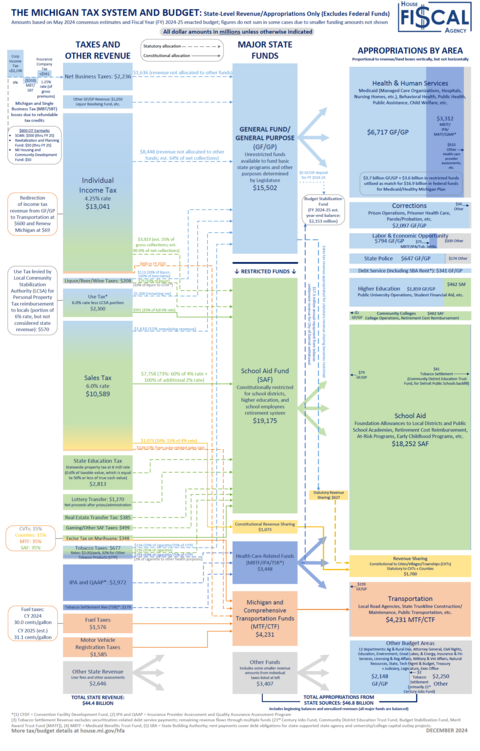

Michigan lawmakers plan to vote on a $3.1 billion road funding package that would draw funding from business subsidy programs and the state gas tax.

The plan would use $1.1 billion of corporate welfare programs and dedicate all gas taxes paid at the pump, about $945 million, to fix the roads.

The state would spend $600 million of increased state revenue and cut $500 million in unspecified spending.

House bills 4180 and 4182 aim to remove the sales and use taxes from motor and aviation fuels, which flow to the general fund and School Aid Fund. The School Aid Fund’s lost revenue would be replaced with $755 million a year from sales tax revenue, according to House Bill 4185, sponsored by Grosse Ile’s Rep. Rylee Linting, a Republican.

House Bill 4183, introduced by Rep. Tom Kunse, R-Clare, would increase the gasoline and diesel taxes by almost 25 cents a gallon. The bill also would offset the revenue lost by ending the sales tax on fuel, and the money would go to the highway fund.

Michigan drivers won’t notice a change in gas prices, Rep. Pat Outman, chair of the Committee on Transportation and Infrastructure, told Michigan Capitol Confidential in a phone interview.

“We are increasing the gas tax, but we're eliminating the sales tax so it’s revenue neutral, and the drivers really won't feel a difference there,” said Outman.

HB 4184 aims to increase the tax on aviation fuel from three cents to eight cents per gallon. It also would create a new “qualified airport fund.” The increased amount would be split 65% to the qualified airport fund and 35% to the state aeronautics fund.

Rep. Steve Carra, R-Three Rivers, introduced House Bill 4186. It would increase the Michigan Business Tax rate from 4.95% to 30%. The bill intends to push several businesses that still file under the Michigan Business Tax to file taxes under the corporate income tax, according to Outman.

Companies that switch to paying taxes through the corporate income tax would immediately forfeit about $500 million worth of Michigan Economic Growth Authority tax credits, Outman said.

House Bill 4187 aims to stop the practice of dedicating corporate income tax revenue to the Strategic Outreach and Attraction Reserve, a program meant to attract large projects via providing corporate subsidies. The first $2.2 billion in revenue generated from the move would be split three ways: 50% to county roads, 40% to city and village roads and 10% to trunk lines.

Any amount more than $2.2 billion generated would go to the General Fund.

The bills are tie-barred, so all must pass the House and Senate and be signed into law by Gov. Gretchen Whitmer to take effect.

Courtesy of the House Fiscal Agency

Courtesy of the House Fiscal Agency

Whitmer called for more road funding through tax increases in her MI Road Ahead plan.

The second-term governor wants to raise the corporate income tax rate from 6% to 8.5% to raise $1.6 billion, tax marijuana at 32% to raise $470 million, and cut an unspecified $500 million in spending to fix the roads.

She did not respond to an emailed request for comment.

Lance Binoniemi, vice president of government affairs at the Michigan Infrastructure and Transportation Association, testified in strong support for the legislation.

Although Brad Williams, vice president of political affairs at the Detroit Regional Chamber of Commerce, mostly supported the package, he was concerned over the proposed removal of economic development incentives through SOAR.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Whitmer seeks $7.8M for road funding solution, six years after pledging to fix the roads

Whitmer seeks $7.8M for road funding solution, six years after pledging to fix the roads

Whitmer wafts 32% tax on pot

Whitmer wafts 32% tax on pot

Michigan roads still crumbling despite nearly 47% budget hike since 2018

Michigan roads still crumbling despite nearly 47% budget hike since 2018