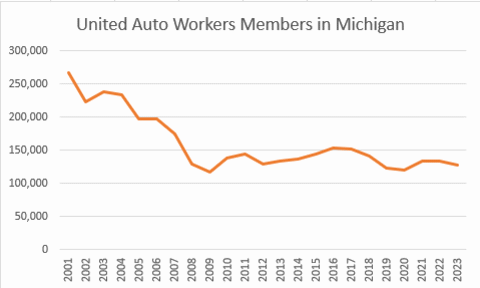

UAW membership drops significantly in Michigan

Membership is the lowest in more than a decade

A year ago, the United Auto Workers was bragging about adding 10,000 members, with the union saying it was “just getting started.” The later held an unprecedented strike, shutting down production for several American automotive plants in a move that led to higher wages and benefits for many auto workers.

But auto companies announced several rounds of layoffs since then, and they have severely cut back on vehicle sale projections, especially for electric vehicles.

Recently released federal filings with the U.S. Department of Labor show that the union’s total membership is at its lowest since 2010, during the depths of the national Great Recession and at the end of Michigan’s economic “Lost Decade.”

The UAW is down to 370,239 active, dues-paying members, a drop of approximately 13,000 from last year. The union had more than 700,000 active members in 2002 before bottoming out at around 355,191 in 2010. This hasn’t hurt the union’s revenue, however. It took in $485 million last year, the most ever.

Membership numbers are even worse for the assorted UAW branches in Michigan. They lost about 6,500 members during the strike year and are now down to 127,458. That’s a 5% drop.

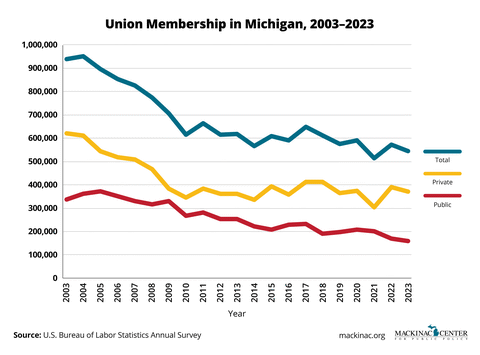

There have been repeated claims from unions and in the media that unions are in a resurgence. But the data doesn’t back that up. Union membership is the lowest-ever level recorded across the United States. In Michigan, union membership is at the lowest level in at least 100 years.

And while surveys show unions are popular in general, few Americans are interested in joining one. Right-to-work laws, which are the main detriment to union power, are exceedingly popular. Michigan, however, repealed its right-to-work law this year.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Michigan must untether itself from UAW

Michigan must untether itself from UAW

Workers at Mt. Clemens tooling company are on the way to decertifying the UAW

Workers at Mt. Clemens tooling company are on the way to decertifying the UAW

UAW enters immigration debate, demands driver’s licenses for illegal immigrants

UAW enters immigration debate, demands driver’s licenses for illegal immigrants

Michigan’s business tax climate is mediocre, survey says

Michigan’s business tax climate is mediocre, survey says

Michigan House OKs bill creating museum tax authority

Michigan House OKs bill creating museum tax authority

Michigan bill would exempt EV chargers from property tax

Michigan bill would exempt EV chargers from property tax