Wayne-Westland School District facing $30M deficit

Deficit caused by overspending, clerical error

Wayne-Westland Community Schools is facing a projected deficit of about $30 million because of a budget error and increased spending.

A clerical error caused about $16 million of that deficit, and the district increased spending by $15 million in 2022-23.

The district adopted a budget with a nearly $9 million deficit as of June 30, 2025, and voted to seek up to $30 million from taxpayers.

A mistake in the 2022-2023 budget approved by the district board noted a one-time payment from the state of Michigan to the Office of Retirement Services as a revenue increase of $8.3 million instead of a net gain of zero.

The district accounted for the revenue but not the expenditure, falsely showing a positive balance of $8.3 million. The mistake was repeated in the 2023-24 fiscal year, compounding to a deficit of $16.7 million.

In other words, the district serving nearly 10,000 students had already spent the money but believed it hadn’t.

“The district is implementing measures to prevent such errors in the future,” it said in a statement.

The district says it will cut spending to reduce the deficit.

“Importantly, the board has publicly pledged to take decisive actions in the coming weeks and possibly months to reduce or eliminate this projected deficit, demonstrating our commitment to financial responsibility,” the statement read.

In 2022-23, the district’s increased spending totaled $15 million across increases, steps, and bonuses across every employee group.

“The district, in recognition of their hard work, provided employees with well-deserved steps, increases, and bonuses, effectively utilizing the surplus fund balance,” the district said.

Board member Mark Neil voted against the budget.

“But again, first of all, the adoption of a deficit budget is a mistake without a plan to immediately eliminate all these problems,” Neil said in the meeting.

The Wayne-Westland Schools district received roughly $49 million in COVID cash to recover from learning loss, move to online learning, and hire extra teachers to follow six-foot separation guidelines. The district has been reimbursed $34 million and has about $14 million remaining, according to the state dashboard.

“The millions of dollars Wayne-Westland Community Schools received in various forms of COVID relief funds helped to camouflage the seriousness of these two factors,” the district said. “With the end of those COVID funds, the district is left with a projection to possibly end the fiscal year 2024-2025 with a deficit of $8,927,613.”

Wayne-Westland isn't alone. A Citizen’s Research Council of Michigan report found many of Michigan’s 800 school districts will have to reduce their staff.

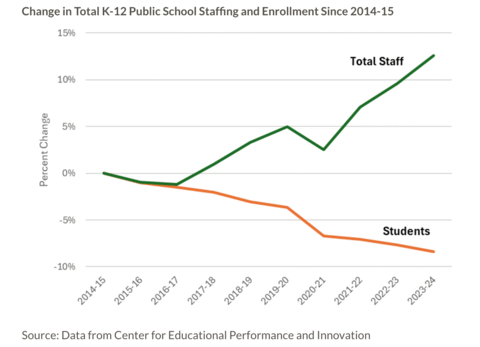

Michigan public schools added almost 5,000 employees in the 2022-23 school year and over 5,800 employees in the 2023-24 school year. Meanwhile, student enrollment has fallen since 2014.

The research council included this graph in its report, showing Michigan school staffing increasing while the student population has dropped.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

.jpg) Michigan schools seek $1.6 billion in new public debt May 6

Michigan schools seek $1.6 billion in new public debt May 6

Legislature targets charter school blight, ignores district-owned eyesores

Legislature targets charter school blight, ignores district-owned eyesores

Michigan House scheduled to vote June 20 on diverting $670M from teacher debt to other projects

Michigan House scheduled to vote June 20 on diverting $670M from teacher debt to other projects