Michigan’s property taxes keep increasing above inflation

Municipalities cry poverty, but the numbers tell a different story

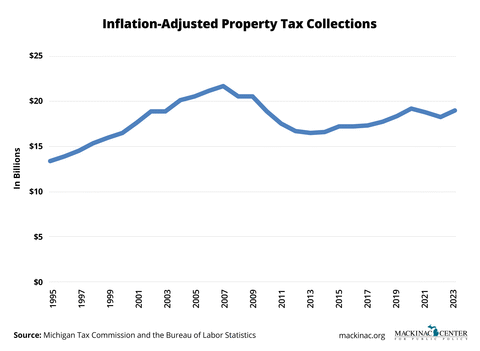

The governments in Michigan that rely on property taxes levy a regular complaint that property taxes are limited. It is true that the state protects homeowners with a couple of property tax limitations. Even with these, property tax collections have been increasing above the rate of inflation for the past decade.

Property taxes raise the most revenue among all of the state and local taxes levied in Michigan. The latest annual report from the Michigan Tax Commission shows that property tax revenue increased from $17.5 billion in 2022 to $18.8 billion in 2023.

Property taxes are levied by state and local governments. Schools get the largest pieces, collecting 43.6% of the property tax. The state assessment, which is earmarked to education purposes, collects another 14.0%. Cities, villages and townships combine for 25.9% of the property tax and counties get 16.5% of the property tax.

Property taxes have been increasing faster than the rate of inflation since 2013. However, collections are still 10.4% below peak property tax collections in 2007.

Property taxes are based on property values, and the decline from peak levels is driven by the market for real estate. Property value assessments have still not recovered to 2007 levels, adjusted for inflation.

Tax rates, however, are up. The average property receives a tax levy of 42.11 mills, slightly below the 42.44 mill high set in 2020, and up from the 38.88 mills levied after the property tax cuts required in 1994’s Proposal A.

State and local governments have been collecting more from property taxes for the past decade. Rates are up, and collections are increasing faster than inflation.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Michigan’s business tax climate is mediocre, survey says

Michigan’s business tax climate is mediocre, survey says

Michigan House OKs bill creating museum tax authority

Michigan House OKs bill creating museum tax authority

Michigan bill would exempt EV chargers from property tax

Michigan bill would exempt EV chargers from property tax