MEA Aggressive With Dues Collection Information; Silent On How To Opt Out

Union executive questioned at MERC hearing about unfair labor practice complaints

LANSING — The Michigan Education Association sent out multiple emails informing its members on how to pay dues, but the union didn't see fit to use its resources to inform members of their right to leave the union.

According to MEA officials, its members can only leave the union if they say they are doing so in writing during the month of August.

"Does MEA have the capacity of telling people about deadlines before deadlines pass?" Mackinac Center Legal Foundation Director Patrick Wright asked Michigan Education Association Executive Director Gretchen Dziadosz at a hearing Wednesday before Administrative Law Judge Julia C. Stern.

Attorney Jeffery Donahue, representing the MEA and the Saginaw Education Association, objected to the question.

Judge Stern overruled the objection, pointing out to Donahue that it was the sort of question typically "asked during direct cross examination."

Dziadosz then answered.

"Well, of course," she said.

The MEA's August window for members to opt out of paying dues or fees is far more restrictive than that of the Detroit Federation of Teachers, a division of the American Federation of Teachers. The DFT allows its members to leave whenever they choose.

In 2013, the MEA had to adjust to two major changes in the law. One was the enactment of Public Act 53, which prohibits school districts from deducting union dues from employee paychecks. The other was Michigan's right-to-work law, which allows people to leave the union when their contract expires and prohibits them from being fired for not paying dues or fees to a union.

In response to Public Act 53, the MEA set up a system it called E-Dues as a means of collecting money from its members. The union also mounted an aggressive information campaign to inform them about E-Dues and encourage members to sign-up to have their dues electronically deducted from their paychecks.

Wright questioned Dziadosz for nearly four hours during Wednesday's hearing, which was a procedural process as part of unfair labor practice complaints filed with the Michigan Employment Relations Commission. Four teachers in the Saginaw Public Schools who want out of the union are challenging the August window and are represented in the lawsuit by the Mackinac Center Legal Foundation.

For most of the hearing, Wright pressed the MEA official about the union apparently not making any effort to inform its members about the August window while simultaneously making repeated attempts to inform them about E-Dues.

Wright read off a list of emails the MEA sent to its members in 2013 to inform them that E-Dues was available and how to sign up for it. The final one he listed was an email sent on Aug. 26, 2013.

"After right-to-work passed in December 2012, did you have discussions about how to respond to [the law]?" Wright asked Dziadosz.

However, all direct questioning along this line was overruled when Dziadosz said all the discussions she recalled during that time period included MEA attorneys, which Donahue pointed out meant that they were subject to attorney-client privilege.

Earlier in her testimony, under questioning by Donahue, Dziadosz talked about the MEA "help desk," a membership information service that members can contact to have their questions answered. She said she had directed those working at the help desk how they were to answer questions about right-to-work.

"I told them they were to answer fully and honestly and those (who wanted to leave the union) were to be provided a form letter to be used," Dziadosz said.

The teachers involved in the lawsuit say they were not given information about how to leave and some had their credit ratings threatened when they tried to refrain from paying dues.

Also during questioning by Donahue, the point was made that the August window is in the MEA's bylaws.

"Are those bylaws available through a Google search?" Donahue asked.

"Yes," Dziadosz responded.

After the hearing, Wright said he wondered why E-Dues information wasn't handled the same way.

"Instead of sending out multiple emails about how to sign up for E-Dues, why didn't they just put the E-Dues information in their bylaws?" Wight said after the hearing.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Carrollton teacher hopes that Michigan lawmaker ‘chokes on a bag of [expletive] and dies’

Carrollton teacher hopes that Michigan lawmaker ‘chokes on a bag of [expletive] and dies’

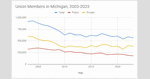

Michigan Education Association is down 37,000 members in a decade

Michigan Education Association is down 37,000 members in a decade

Right-to-work no longer rules in private sector

Right-to-work no longer rules in private sector

Why Tax Rate Cuts Matter More Than Increasing Credits and Exemptions

With more tax money coming into the state treasury than the state expects to spend, politicians are considering proposals to reduce taxes.

One plan would lower the tax rate over time and the other would increase some credits and exemptions. In evaluating the proposals, politicians should care primarily about the influence the proposals will have on state economic growth.

The tax policies that influence long-term economic growth are the ones that improve decision-making on the margin. All things being equal, there are some ideas that don't make sense when they're taxed at 29.25 percent (current rates for a middle tax bracket when federal and state income taxes are applied) than they are at 28.9 percent (rates after implementation of the proposed reduction in state income tax rates).

The difference might not sound like much, but they can affect the thousands of hiring and firing decisions that are made daily. Michigan's economy added 217,038 private sector jobs and lost 200,728 private sector jobs in the second quarter of 2013. It is a change in tax rates that can make more of those decisions to add workers feasible and less of a reason to lower employment.

The other tax proposal does not lower tax rates at all. It adjusts tax policies that encourage home ownership and the treatment of retirement income. These policies can influence the decision to buy a home or rent one and decisions about where to retire. But their impact on long run growth is less clear.

Some businesspeople — like real estate agents and home builders — will appreciate increases in these credits and exemptions. Yet this is only a small portion of the economy. And pensioners may spend more if they are allowed to keep more of their income. But the decisions on whether to expand or contract will only be indirectly affected by these changes in tax policy.

Changing these credits and exemptions can have other influences as well. Crediting home owners for paying property taxes has an ancillary consequence of making it easier to raise property taxes. When local governments, school districts and other property taxing authorities can raise taxes and their constituents pay a portion of it, they are more likely to request these rate increases.

Some state politicians, however, don't care as much about those effects as they do about who will receive the abatements. Pensioners and home owners vote and politicians may feel necessary to show voters that they are letting them keep more of their money than would otherwise be the case.

Improving the factors in the decision-making that businesses go through when adding or losing jobs improves the state economy. A more prosperous state is one that can better meet the needs of the people in the state.

This is better served by broad-based drop in the tax rates than in changing credits and exemptions.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Want to support our work?

Keep free-market news flowing with your gift to Michigan Capitol Confidential today

Make a gift! Already a supporter

More From CapCon