Commentary

Targeted Business Subsidies vs. Broad Tax Relief

State lawmakers think subsidies improve the economy more

There is a massive turnover of jobs that goes on without politicians having much say or influence.

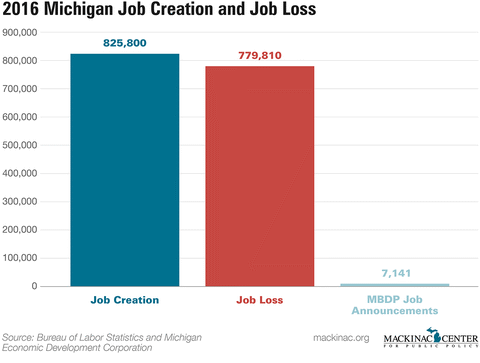

According to data from the Bureau of Labor Statistics, Michigan added 825,800 jobs in 2016 and lost 779,810 jobs. That is the equivalent of adding and losing roughly one out of every five jobs in just a single year.

State lawmakers approved two new programs to subsidize businesses, promising that they would create jobs. At most, those programs award deals to employers for only handfuls of jobs. The state never got out of the subsidy business. The deals they sign, however, tend to cover only a fraction of the job picture. The Michigan Business Development Program, the state’s primary business expansion grant, offered 84 deals for what state officials expect to create 7,141 jobs.

Many of these are never going to show up. And for the ones that do, it shouldn’t be assumed that the projects would have only happened with state subsidies. And even then, that doesn’t justify the $64 million of taxpayer dollars pledged to these companies. There are economic consequences for business subsidy expenditures.

If all of these jobs actually happen and would not have occurred without state support and if there were no negative economic consequences to taking money from everyone and giving it to select business interests, this “economic development” program would only account for 1.1 percent of the actual job creation in the state.

And that is why the state’s economic development programs simply can’t drive the economy. Even if they could justify their costs, selective deals simply have too limited of a scope to drive a large and dynamic state economy. What can be effective are broad-based improvements to the business climate.

And the state can afford broad-based tax cuts.

The state’s two new programs authorize $1.2 billion in transfers from taxpayers to business owners. One plan would only have a maximum annual cost of $40 million, and the other authorizes its spending over 10 years, so perhaps a $20 million annual cost. That is in addition to the $627.4 million expected to be paid out in old business tax subsidies and the $170.9 million in new subsidies approved in the budget, plus another $25.7 million to administer them. All told, it’s $884 million taken from taxpayers for economic development purposes next year. And that’s not including all of the other preferences, like industrial property tax abatements, that give privileges but do not redistribute money from taxpayers to businesses.

That is enough money to bring the state income tax down from 4.25 percent to 3.9 percent. The question is whether the state would be better off if the people that made the thousands of decisions to employ more or fewer workers in the state were allowed to keep $884 million more of their money, instead of taxing it from them to give to select business interests.

There are some lawmakers that seem to believe that economic development is better served by handing subsidies out to a few companies than letting all their constituents keep it.

|

Targeted Business Subsidies vs. Broad Tax Relief

State lawmakers think subsidies improve the economy more

There is a massive turnover of jobs that goes on without politicians having much say or influence.

According to data from the Bureau of Labor Statistics, Michigan added 825,800 jobs in 2016 and lost 779,810 jobs. That is the equivalent of adding and losing roughly one out of every five jobs in just a single year.

State lawmakers approved two new programs to subsidize businesses, promising that they would create jobs. At most, those programs award deals to employers for only handfuls of jobs. The state never got out of the subsidy business. The deals they sign, however, tend to cover only a fraction of the job picture. The Michigan Business Development Program, the state’s primary business expansion grant, offered 84 deals for what state officials expect to create 7,141 jobs.

Many of these are never going to show up. And for the ones that do, it shouldn’t be assumed that the projects would have only happened with state subsidies. And even then, that doesn’t justify the $64 million of taxpayer dollars pledged to these companies. There are economic consequences for business subsidy expenditures.

If all of these jobs actually happen and would not have occurred without state support and if there were no negative economic consequences to taking money from everyone and giving it to select business interests, this “economic development” program would only account for 1.1 percent of the actual job creation in the state.

And that is why the state’s economic development programs simply can’t drive the economy. Even if they could justify their costs, selective deals simply have too limited of a scope to drive a large and dynamic state economy. What can be effective are broad-based improvements to the business climate.

And the state can afford broad-based tax cuts.

The state’s two new programs authorize $1.2 billion in transfers from taxpayers to business owners. One plan would only have a maximum annual cost of $40 million, and the other authorizes its spending over 10 years, so perhaps a $20 million annual cost. That is in addition to the $627.4 million expected to be paid out in old business tax subsidies and the $170.9 million in new subsidies approved in the budget, plus another $25.7 million to administer them. All told, it’s $884 million taken from taxpayers for economic development purposes next year. And that’s not including all of the other preferences, like industrial property tax abatements, that give privileges but do not redistribute money from taxpayers to businesses.

That is enough money to bring the state income tax down from 4.25 percent to 3.9 percent. The question is whether the state would be better off if the people that made the thousands of decisions to employ more or fewer workers in the state were allowed to keep $884 million more of their money, instead of taxing it from them to give to select business interests.

There are some lawmakers that seem to believe that economic development is better served by handing subsidies out to a few companies than letting all their constituents keep it.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

More From CapCon