State Fails to Make Required Teacher Pension Fund Contribution

Superintendent: 'It’s huge. You can’t keep up with it'

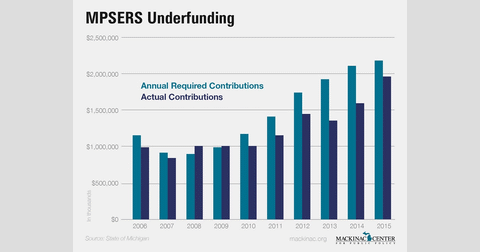

For the sixth year in a row, Michigan officials failed to pay the full amount the state's own experts say is required to adequately fund the school employee pension system. In addition to the risks associated with adding to the billions in unfunded liabilities the system has already accumulated, this is also imposing more stress on local school budgets.

According to rules of a defined benefit pension system, the state is supposed to contribute an amount called the “annual required contribution,” or ARC, into the Michigan Public School Employees Retirement System (MPSERS) every year. For 2015, actuarial accountants say that comes to $2.18 billion.

But the state of Michigan paid just $1.97 billion, a $210 million shortfall. The last year the state fully paid the recommended amount was 2009, and since then, the cumulative underfunding has totaled $2.03 billion.

“Underfunding pensions kicks the costs for current service into the future and is unfair to teachers, administrators and taxpayers alike,” said James Hohman, the assistant director of fiscal policy for the Mackinac Center for Public Policy.

Dexter Community Schools Superintendent Chris Timmis said if a school district had demonstrated the same pattern of underpayment, “We’d be taken over (by the state).”

Dexter has seen its required pension contributions increase from $3.6 million in 2009 to $5.37 million in 2015, in part to make up for past underfunding of the system as a whole. The total unfunded liability accumulated by the state-run school pension system is currently $26.5 billion.

Every year, school districts are having to dedicate larger sums to cover the escalating costs of the defined-benefit pension system.

“MPSERS is wiping out our budgets already,” Timmis said. “It’s huge. You can’t keep up with it.”

Bills have been submitted in the state House and Senate that would shift new school employees to a 401(k)-type plan, which would cap the state's retiree liabilities. All new state employees hired since 1997 are in this type of defined contribution system, while new school employees are still being enrolled in the defined benefit pension system.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Faulty assumptions led to $2.3 billion catch-up on Michigan school pensions

Faulty assumptions led to $2.3 billion catch-up on Michigan school pensions

Michigan Teacher Shortage Turns 102 Years Old

Michigan Teacher Shortage Turns 102 Years Old

Michigan’s largest debt declines

Michigan’s largest debt declines