Fixing Michigan's Budget-Killing School Employees' Pension Up in the Air

MPSERS reform may be murky

Anyone seeking evidence that the new state Senate would vote to reform the Michigan Public School Employees’ Retirement System by putting new employees into 401(k) plans may be disappointed. Based on responses from six GOP Senators who were not in office when the question came up for a vote nearly three years ago, the prospect is a murky and tenuous “maybe.”

In what was seen as a surprise move at the time, on May 17, 2012, the Senate voted 20-18 to close the pension system to new hires and offer them 401(k)-style plans in its place. But then the House (and possibly the administration of Gov. Rick Snyder as well) rejected the reform and it was never enacted.

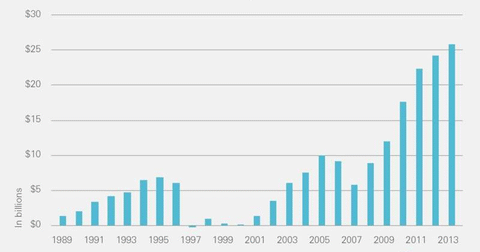

Closing the system to new hires would gradually end the ongoing underfunding of the pension system, which saw its required annual contributions increase from $989 million in 2009 to $1.9 billion in 2013.

The system is in such bad shape that 30 percent of school payroll costs go to the system, and 87 percent of that goes to playing catch-up on past underfunding.

Here's how a potential Senate vote tally stacks up, based on an assumption that all of the returning Republican senators would vote the same way as they did in 2012 and all the Senate Democrats would again oppose it.

Under that likely scenario, a "yes" vote from seven of the eight first-term GOP senators would be needed for a similar measure to pass. These eight key senators are: Peter MacGregor, Rockford; Ken Horn, Frankenmuth; Marty Knollenberg, Troy; Margaret O’Brien, Portage; Wayne Schmidt, Traverse City; Mike Shirkey, Clarklake; Jim Stamas, Midland; and Dale Zorn, Ida.

There is an outside chance of the Senate adopting the reform with the vote of only six of the eight new senators, but that would happen only if Lt. Gov. Brian Calley were to vote “yes” to break a 19-19 tie. For that scenario to play-out, Gov. Snyder would have to be in favor of the reform.

Although Sen. Arlan Meekhof, R-West Olive, the new majority leader, has supported the reform, it is unlikely he would bring it up for a vote unless he were sure he had enough votes for passage. Caucus leaders rarely force their colleagues to vote on significant bills in a losing effort.

Michigan Capitol Confidential emailed the eight new GOP senators, asking if they would vote “yes,” vote “no” or “were undecided about how they’d vote” if the reform was brought up on the Senate floor. Follow-up telephone calls to their offices were also placed. O’Brien declined to comment and Stamas has has yet to respond.

Here are the responses of the other six senators:

Schmidt:

“I have voted in favor of making the change from defined benefit to defined contribution at the local level when I was on the Traverse County Board of Commissioners back around 1999-2000,” Sen. Schmidt said. “I still believe I made the right vote; however, when we made that transition there were some ramifications resulting from having fewer people paying into the system than were receiving payments from it.”

“With the MPSERS pension system the numbers involved are larger all around,” he continued. “We have to carefully look at all of the ramifications and compare options, including possible hybrids. Before deciding what to do, we need to make sure we’re well aware of the consequences.”

Shirkey:

“Unless I saw new information, by that I mean data that would change my assessment, I would still support closing it off sooner rather than later,” he said. “There are no painless solutions and bad news seldom gets better with age.”

MacGregor:

“In general, I’m all for it if the proof is in the details,” he said. “I think we’re better off looking 20 to 40 years ahead and if we can take care of a problem now that’s going to grow worse with time, we should do it now. The difficulty comes with trying to figure out how to pay for it. What really matters is whether a vote cast now still looks good 20 years from now; if it does, then it was a good decision.”

Knollenberg:

"Transitioning to a 401(k) plan for new hires as a way to address our state's chronically underfunded pension system is a model that the private sector is already doing and should be considered."

Horn:

“In terms of moving school employees to a 401(k) system, I just need to read the bill,” he said. “Public pensions have their advantages as do defined contribution plans. According to Forbes Magazine, pensions tend to out-perform 401(k)s over longer periods of time and pensions, by design, prevent employee turnover, which I detested when I owned my own business. On the other hand, they have a tendency to be underfunded, and often used as a piggy-bank for government spending.”

“It’s not a bad thing for employees to have some stake in managing and preparing for their own retirement,” Horn continued. “Pensions tend to lull employees into indifference to taxpayer-funded benefits. I really dislike the notion that my one year-old grandson will have to pay to keep the promises that our grandfathers made to the state’s public employees, considering underfunded pensions, bankruptcies and ever-changing legislatures. Considering that, according to the governor’s office, Michigan will be debt free in 2038, I would need to see what a full withdrawal from defined benefits will do to the system. I would, at this point, paraphrase Albert Einstein; we should make this as simple as possible, but … not simpler than possible.”

Zorn:

“There are some real questions on this because of the upfront costs involved, couple that with the budget shortfall and I am not sure it is feasible at this time,” he said.

The six Republican senators who voted against closing the pension system in 2012 were: Tom Casperson, Escanaba; Mike Green, Mayville; Goeff Hansen, Hart; Rick Jones, Grand Ledge; Mike Nofs, Battle Creek; and Tory Rocca, Sterling Heights. All of these senators have returned for a second term.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Benton Harbor pension system only 39% funded

Benton Harbor pension system only 39% funded

Lansing’s $402M pension problem could become ours

Lansing’s $402M pension problem could become ours

Faulty assumptions led to $2.3 billion catch-up on Michigan school pensions

Faulty assumptions led to $2.3 billion catch-up on Michigan school pensions