State Budget Shifts Extra Revenue Sharing Funds To Detroit

Detroit to receive $140.5 million; Grand Rapids and Flint to get $12 million combined

Fresh off the Michigan Legislature approving a $195 million bailout for Detroit, some elected state officials and the governor are looking to favor the city again, but this time with the statutory revenue sharing.

Detroit is budgeted in 2014-15 to receive $140.5 million in the money taken from sales tax revenue, a $4.2 million increase from 2013-14. That’s what is proposed in Gov. Rick Snyder’s budget, which is in committee.

By comparison, the city of Flint is budgeted to receive $6.7 million in state shared revenue and Grand Rapids is expected to receive $5.3 million in 2014-15. Detroit has a population of 701,475 while Grand Rapids has 190,411 residents and Flint has 100,515 residents.

Detroit would get 56 percent of all the statutory revenue sharing in 2014-15. There are about 500 municipalities that are eligible to receive statutory shared revenue.

"The state is the most generous with Detroit by far with statutory revenue sharing,” said James Hohman, assistant director of fiscal policy at the Mackinac Center for Public Policy.

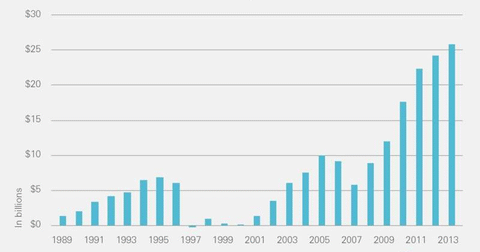

Detroit officials as well as some others have continuously said that Detroit is not getting enough money from the state. For example, the Michigan Municipal League, which represents local communities and advocates on their behalf at the state and federal level, released a report earlier this year that said $6.2 billion in revenue sharing has been "diverted" from local communities. Detroit reportedly lost out on $732 million from 2003 to 2013, according to the Michigan Municipal League report.

Michigan Capitol Confidential is the news source produced by the Mackinac Center for Public Policy. Michigan Capitol Confidential reports with a free-market news perspective.

Feedback mostly opposes Grand Rapids climate plan

Feedback mostly opposes Grand Rapids climate plan

Grand Rapids scores $252M from taxpayers for new soccer stadium

Grand Rapids scores $252M from taxpayers for new soccer stadium

Grand Rapids seeks feedback on climate action plan

Grand Rapids seeks feedback on climate action plan

Don’t redirect pension funds

Don’t redirect pension funds

Michigan’s largest debt declines

Michigan’s largest debt declines

Lansing’s $402M pension problem could become ours

Lansing’s $402M pension problem could become ours